aTP- Arab tourism portal News- Lekha Nair, the CEO of the Seychelles Pension Fund is organising a Symposium on the 30 January at the International Conference Centre in Victoria.

This fund belonging to the People of Seychelles is today guaranteeing a pension to each and every Seychellois in one way or another on retirement age.

all employees

A journalist from the near-by island of Mauritius recently dug into what it is the Seychelles Pension Fund that is able to cover all employees in formal employment, self employed, part-time and casual workers a pension on reaching retirement age.

Seychelles today has a mandatory retirement age of 63 and an optional retirement age of 60. The contributions to this Seychelles Fund is at 4% of which 2% is contributed by employees and 2% is contributed by the employers.

Lekha Nair as the CEO of the Seychelles Pension Fund states proudly that every Seychellois benefits a pension of Seychelles Rupees 5050 when they reach 63 years old.

This is no easy feat for a small country with only a relatively small work force by the Fund that is managed outside of the island’s Civil Service has its own Board but is a Fund that remains for and belongs to the People of Seychelles.

Vision

The Vision of the Seychelles Pension Fund established in 2006 states that it will be a leader and a model retirement system by providing the best retirement and related benefit package for it members. The Fund under the management of its CEO is investing on what they say is ‘prudent investments’.

Mrs Nair says that contributions in the fund she manages is the lowest in the world at 4% only whereas in OECD countries it stands at 14 to 17 %, on Mauritius it stands at 10%.

The 30 January Symposium is set to open the eyes of the Seychelles public, the real owners of that pension fund aptly called the Seychelles Pension Fund.

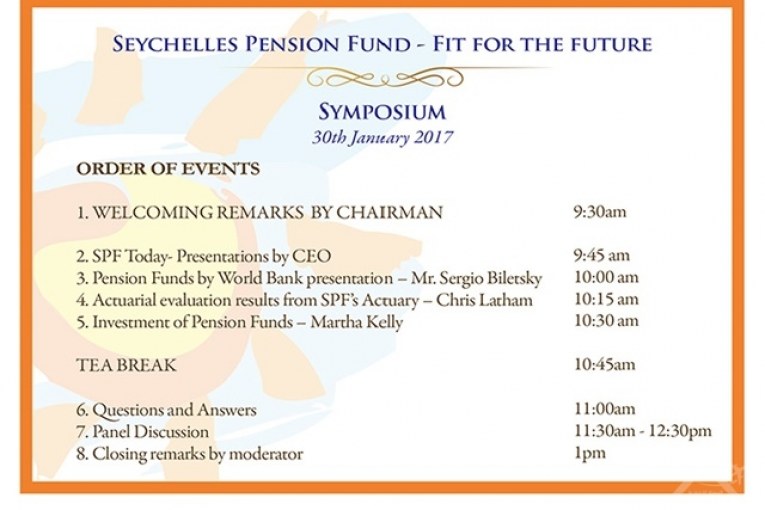

The program for the Symposium announces a Welcoming Address by the Chairman of the Fund before a Presentation of the Fund by the CEO Lekha Nair.

She will be followed by a World Bank presentation made by Sergio Bilersky on Pension Funds and an Actuarial evaluation results from the Fund’s Actuary by Chris Latham.

Martha Kelly will also address on Investments of Pension Funds before a session on Question & Answers that will be followed by a Panel Discussion.

The Seychelles Pension Fund is moving forward with major investments and is today a respected body in the Seychelles