Almasalla news | Arab Tourism Portal News

Jordan’s tourism sector boomed prior to the Covid-19 pandemic, and following a rebound from the 2020 collapse the industry is expected to surpass pre-pandemic levels in 2022, with further growth on the cards in the years beyond according to a strategic market analysis by Glasgow Consulting Group.

The new report by Glasgow Consulting Group (a research and management consulting firm) assesses the development of Jordan’s tourism economy between 2015 and today, and uses a combination of research methods to predict its future.

As it stands, Jordan’s population of just over 10 million receive between 2 and 3 million inbound tourists per year, with that number on an upwards trend.

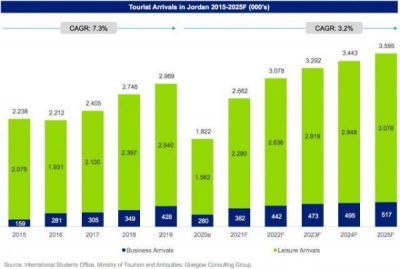

Between 2015 and 2019, inbound tourism increased from 2.23 million arrivals to 2.97 million, representing a CAGR of 7.3%. The growth was mainly driven by the government’s efforts in promoting archeological and cultural sites in the country. According to the national tourism office, Jordan is home to over 100,000 archeological and tourist sites including heavyweight attractions Petra and Jerash.

Not surprisingly, tourist arrivals declined in 2020 by 39%, mainly due to Covid-19-related travel restrictions (Jordan restricted international travels from March 2020 till September 2020 to minimise the spread of the virus).

The tourism sector is set for a strong revival according to Glasgow Consulting Group, with international tourist arrivals expected to reach 3.5 million in 2025. While the majority of foreign tourists visit Jordan for leisure, the share of business travelers is predicted to grow as major cities such as capital Amman grow their economic influence in the region.

Who is visiting Jordan?

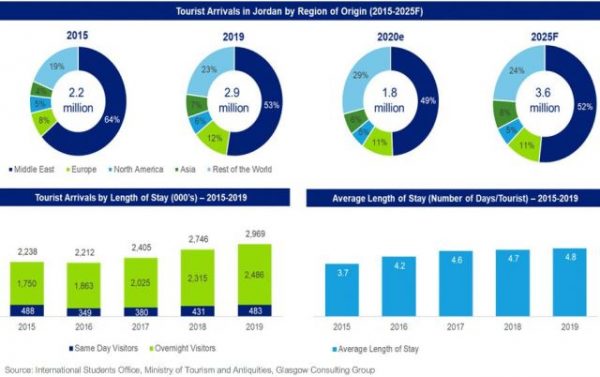

Regional tourists account for over half of all tourists arriving in Jordan, with Saudi Arabia, Iraq, and Israel the key countries of origin (as tourists can for example drive to Jordan for a one day short tour as part of their regional tour).

Looking ahead, arrivals from Asia are expected to outpace other regions, increasing at a CAGR of 6.1%. Europe follows, with Russia, German, France and Italy the countries that are most represented among Jordan’s tourist nationality mix.

Where do they stay?

In 2020, available accommodation units for tourist in Jordan reached 1,764 units, increasing from 1,032 units in 2015, representing a CAGR of 11.3%. The growth was mainly driven by an increase in short-term rental accommodation units such as homestays. The higher demand for these short-term rental is mainly driven by budget tourists, and tourists who wish to experience the ‘local culture’ by staying at home (as opposed to hotels).

Amman is by a distance Jordan’s most popular attraction, accounting for 37% of all tourist arrivals and 45% of all tourist nights in the country. Petra, a historic and archaeological city in Jordan’s southwestern desert that dates to around 300 B.C. (then the capital of the Nabatean Kingdom), is the second most visited destination.

Aqaba is the third most visited city, accounting for 13% of tourist visits and 17% of tourist nights. The city is particularly popular among sportive tourists that enjoy water sports such as scuba diving, wind surfing, water skiing, and snorkeling. Other popular cities/regions are: the Dead Sea, Wadi Rum, Madaba and Tafeleh.

How much are they spending?

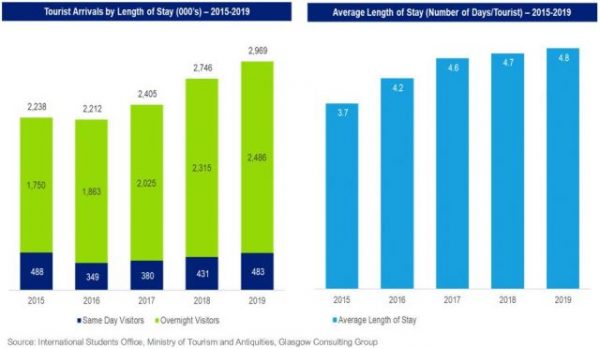

On average, tourists visiting Jordan stay longer and visit more tourist attractions than they did a few years ago.

In 2015, 1.7 million tourists visited country on an overnight trip, which increased to 2.5 million in 2019. During the same period, the number of tourists visiting on same day trip declined from 488,000 to 483,000. As a result, the average length of stay increased gradually, from 3.7 nights per tourist in 2015 to 4.8 days per tourist in 2019.

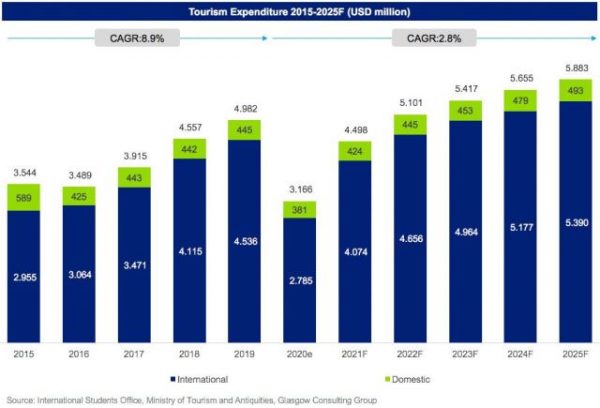

During 2015-2019, international tourist expenditure increased at a CAGR of 11.3%, with per tourist expenditure increasing from $1,320 to $1,528. In 2019, total tourism receipt was estimated to be $4.9 billion, a number which is expected to increase to $5.8 billion by 2025.

In related news, according to recent research from IBISWorld, the size of the global tourism sector fell from $1.9 trillion in 2019 to $1.1 trillion in pandemic-hit 2020. This year, around $200 million of the revenue wiped off is expected to return, seeing the industry end the year at an expected value of $1.3 trillion.